From June 4 to 5, the Huawei Global Intelligent Finance Summit HiFS 2025 in China was successfully held in Dongguan. As one of Huawei’s key partners in the financial sector, Sunline was invited to attend the summit and share insights on modern core construction and intelligent innovation. With outstanding performance in ecosystem collaboration and technology integration, Sunline participated in the launch ceremony of Huawei’s Financial Distributed New Core Solution 5.5 and was awarded the title of “Preferred Solution Development Partner.”

Driving Innovation - Accelerating Financial Core Modernization

At the Core Modernization Forum, Tang Shi, Deputy General Manager of Sunline’s Digital Finance Solution Department, delivered a keynote speech titled “Empowering with Technology: The Innovative Path to a Modern Financial Core.”

Under the dual drivers of business growth and technological innovation, it has become an inevitable trend for financial institutions to reshape their core systems. Sunline’s modernized core system, designed based on enterprise-level architecture theory, achieves four key transformations, provide accurate business expression, integrated business-technology synergy, advanced and flexible architecture, and lean R&D model — helping banks enhance user experience, improve efficiency and quality, and strengthen business resilience.

Sunline’s next-generation distributed core banking system, built on the concept of “intelligent modularization,” supports the digital and intelligent transformation of banking operations. It adopts a new “microservices + modular” distributed architecture and an enterprise-level capability-centric design philosophy. This enables a new mode of core business processing characterized by fine-grained, decoupled, integrated, reusable, and evolvable business capabilities that fully supporting rapid innovation of financial products and reconstructing business processes.

As an industry innovation pioneer, Sunline has also led the way in exploring intelligent development of new core systems by creating the “AI Digital Productivity Platform.” Centered around AI agents, the platform uses AI-native thinking to reconstruct the paradigm of core system development, redefining the entire R&D process from requirement analysis to design, development, and testing, thus greatly enhancing the efficiency of bank core system development.

To further enable effective collaboration between upper-layer applications and foundational infrastructure, Sunline and Huawei have joined forces to launch multiple industry-leading solutions, jointly promoting innovation in modernized financial cores.

Joining Forces for Shared Success

Co-Creating a New Paradigm of Intelligent Finance

At HiFS 2025, Huawei, together with Sunline and 12 other partners, officially launched the Financial Distributed New Core Solution 5.5. The solution features a comprehensive modernization and AI-driven upgrade across four dimensions — platform, data, process, and operations, accompanying financial institutions throughout their modernization journey.

During the “Mainframe-to-Cloud: Cloud-Native Transformation of Core Applications” roundtable session, Sun Shisheng, Assistant to the President of Sunline, engaged in an in-depth discussion with other panelists on Kunpeng-native development, sharing Sunline’s practical experience in applying it within banking scenarios.

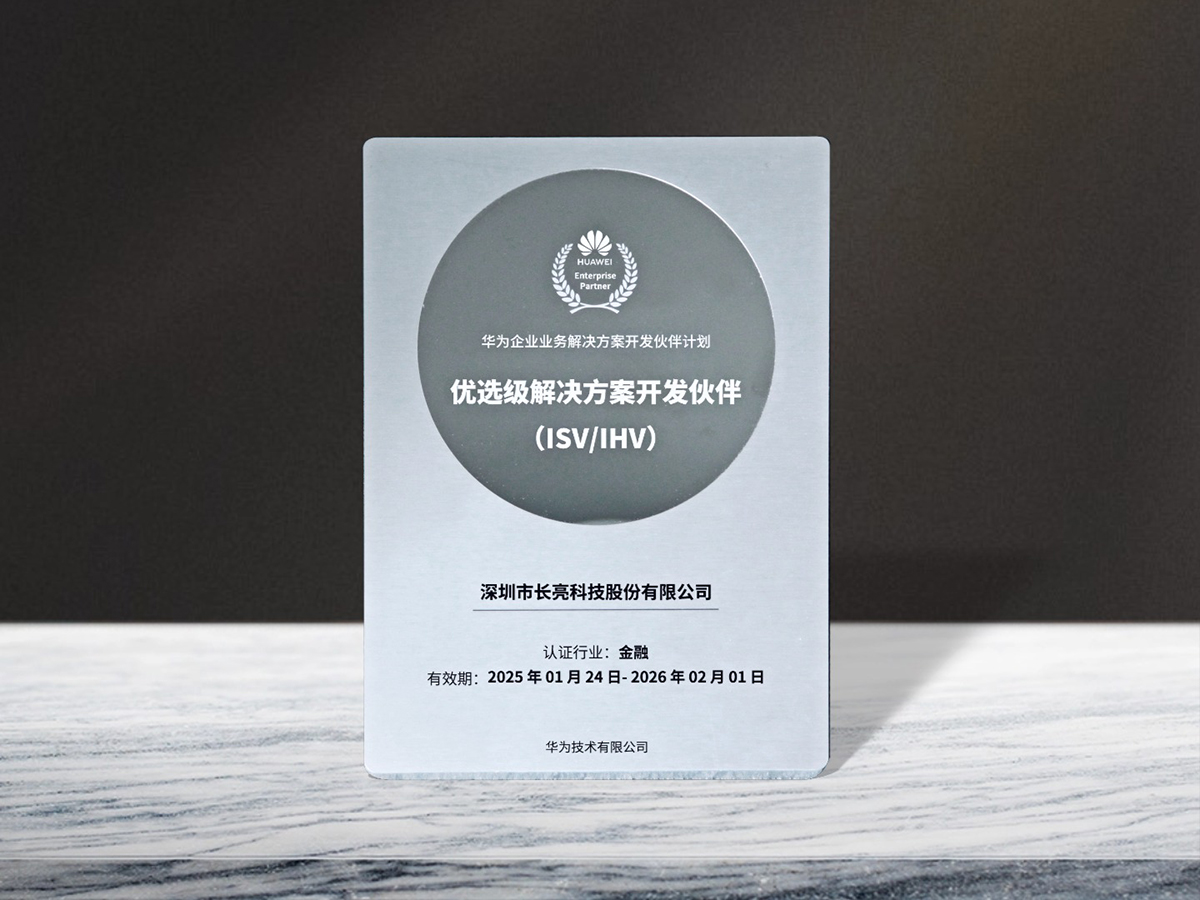

At the event, Sunline was officially certified as Huawei’s “Preferred Solution Development Partner” in the financial industry, signifying Huawei’s multi-dimensional recognition of Sunline’s technological innovation, market influence, and ecosystem collaboration achievements.

Looking ahead, Sunline will continue to leverage its deep technical expertise in core applications, further strengthen its strategic cooperation with Huawei and other ecosystem partners, and jointly explore innovative paths to accelerate core modernization and AI-driven value realization, empowering the financial industry’s intelligent transformation.