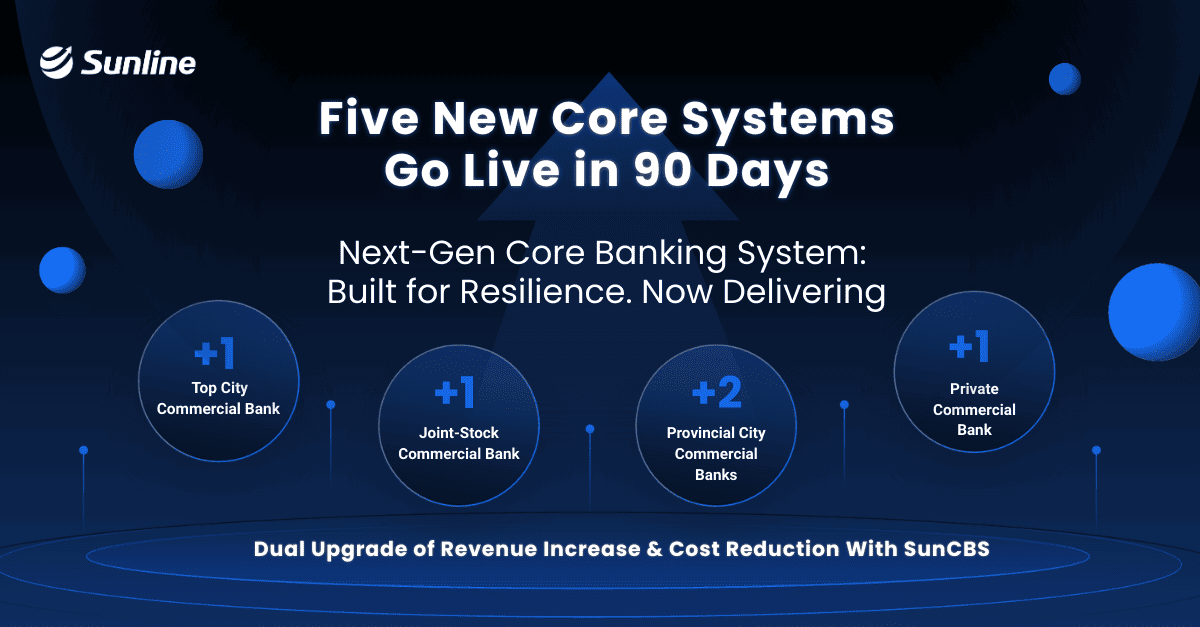

Sunline has successfully go-live with SunCBS, a next-generation Distributed Core Banking System at five China banks in the past three months.

This achievement sets a definitive benchmark for the digital transformation of both nationwide joint-stock commercial banks and regional banks in China. SunCBS has demonstrated excellent stability and scalability, delivering effective improvements in processing efficiency and business support capabilities. This momentum solidifies the banks' digital foundation necessary for serving the real economy.

The new core system leverages an enterprise-level microservices framework and application development platform, employing a brand-new "Microservices + Cell Deployment" distributed architecture. This design supports the flexible combination and splitting of business service deployment, enabling flexible unit-based deployment and rapid capacity expansion. This technical foundation is crucial for banks looking to enhance customer experience, accelerate service response times, and empower business innovation.

SunCBS is not only capable of supporting explosive future business growth and meeting the massive data and transaction processing demands of the Big Data era. it also uses technology to drive comprehensive integration and optimization of business functions. This enables banks to rapidly capture customer needs with agile product, pricing, and marketing strategies, allowing them to seize the initiative in a constantly changing market.

As the banking industry enters a period of intensive new core system deployment, Sunline's technical strength and delivery capability have been deeply validated across the sector. Looking ahead, Sunline will continue to provide more advanced technology, more reliable products, and more professional services to forge a secure, efficient, and intelligent "Financial China Core", incline wiith the digital bedrock for banks facing the opportunities of the 15th Five-Year Plan.