Jakarta, Indonesia – August 7, 2025 – More than 100 senior leaders from Indonesia's top banks, regulatory bodies, and technology partners gathered at the Banking Summit Indonesia 2025 to chart the nation's next phase of core banking transformation. Hosted by Sunline, in collaboration with the Indonesian Banking Development Institute (LPPI), the summit unified industry, regulators, and innovators under a shared vision for AI-driven, resilient, and scalable banking infrastructure.

With the theme "Modernizing Core Banking: Embracing AI-Powered Transformation," the forum was backed by strategic partners Huawei, Huawei Cloud, PwC, and Digital Mahadata, underscoring the importance of public–private collaboration in shaping Indonesia’s financial future. The event featured regulators from Otoritas Jasa Keuangan (OJK), technology leaders, and executives from major financial institutions, delivering both strategic direction and actionable pathways for modernization.

In a keynote that underscored the forum’s significance, Teguh Supangkat, Deputy Commissioner for Supervision of Financial

Conglomerates at OJK, called for a new era of core banking resilience.

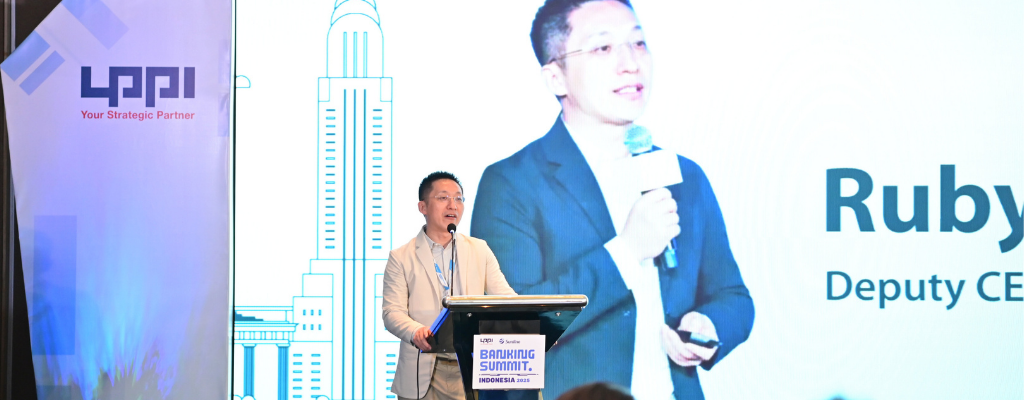

"Indonesia is entering a decisive chapter in core banking transformation — and we’re proud to help lead that momentum," said Ruby Zhou, Deputy CEO of Sunline International. "Since 2017, Sunline has partnered with local banks to localize innovation and deliver future-ready solutions that align with both market needs and regulatory priorities."

Sunline executives delivered high-impact insights throughout the day. Fahmi Ridho, Banking & Financial Technology Specialist, Sunline Indonesia, addressed the capability gaps in legacy systems, urging banks to act decisively. Charley Dou, Vice President of Technical Solutions, Sunline International, detailed a phased, scalable modernization roadmap for Southeast Asia. Fahmi Mustafa, Head of Islamic Banking, Sunline International, showcased innovation in Sharia-compliant banking solutions, while Simon Lai, Principal Solutions Architect, Sunline International, demonstrated how DataMind and AIStack deliver real-time intelligence and operational agility.

A high-level panel brought together Jacqueline Niu, Chief Solutions and Marketing Officer, Sunline Group; Heri Atoko, Senior Vice President of Retail Digital Delivery, BNI; Eddy Suryanto, APAC FSI Solution Consultant, Huawei; and Jonathan Sharp, Strategy & Partner Financial Services Operations, PwC.. Together, they discussed modernization readiness, infrastructure agility, and the path from strategy to execution, offering perspectives from banking, technology, and consulting leaders.

Partner contributions in the afternoon sessions further expanded the conversation. Yahya Laksana, Senior Storage Product Manager, Huawei, shared innovations in storage solutions; I Gusti Gede Krisna Dewantara, Solution Architect, Huawei Cloud, discussed smart data management for scalable banking; and Danny Bravijaya, IT Consultant for Banking, Digital Mahadata, presented AI-powered fraud detection strategies.

Looking Ahead

Beyond keynote speeches and technical sessions, the summit fostered candid discussions during networking breaks and a gala dinner, building momentum for joint initiatives. Sunline’s roadmap includes continued collaboration with regulators, deeper integration of AI into core banking systems, and expanding its partner ecosystem to accelerate Indonesia’s modernization agenda.