On June 18, 2025, the China International Financial Exhibition (中国国际金融展) opened at the Shanghai World Expo Exhibition & Convention Center, bringing together financial leaders, technology providers, and industry innovators. At this premier event, Sunline brought its themed booth: “Let AI Truly Understand Finance.” The company presented its latest developments in AI applications, intelligent product architecture, and overseas implementation practices—positioning itself as a spotlight exhibitor within the fintech sector.

AIStack: Accelerating AI Adoption Across the Financial Value Chain

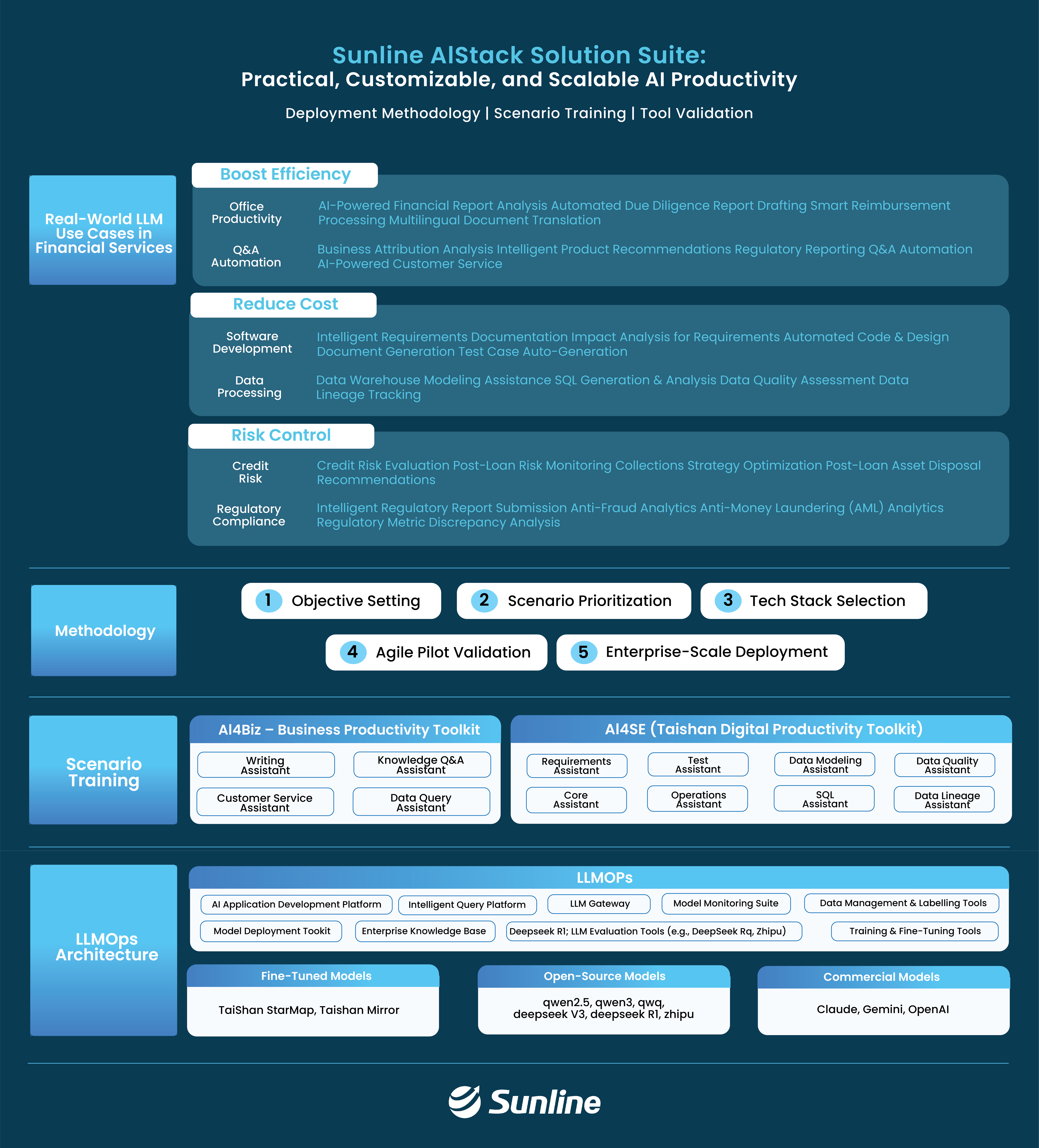

As the financial industry moves from isolated AI experiments to full-stack transformation, Sunline introduced AIStack, its proprietary AI-native digital productivity platform. AIStack is engineered to embed large language model (LLM) capabilities directly into software engineering and financial operations—forming a comprehensive product ecosystem tailored to the needs of modern financial institutions.

At the exhibition, Sunline demonstrated AIStack’s framework, deployment cases, and the real business outcomes that financial institutions can unlock through intelligent transformation.

AIStack Empowers Software Engineering Practices

The application of large language models (LLMs) in the financial sector often faces four major challenges:

1. Insufficient comprehension by general-purpose models

2. Fragmented domain knowledge

3. Difficulty in mapping complex relationships

4. High deployment costs.

In response, Sunline has developed the “Taishan Digital Productivity Tool Suite”—a mature product framework designed to ensure high-certainty AI implementation in finance.

At its core are Sunline’s proprietary, fine-tuned LLMs for the financial sector, including “Taishan Star Map” and “Taishan Mirror”. These models are deeply integrated with enterprise-grade financial knowledge assets and powered by knowledge graphs to decode complex financial relationships.

To further enhance productivity, Sunline has built a range of domain-specific expert agents that support key scenarios across application and data development workflows—enabling financial institutions to adopt a new paradigm in R&D.

Leveraging AIStack’s capabilities in development efficiency, Sunline is driving intelligent exploration in building next-generation core systems. Through a multi-agent collaboration ecosystem, the company is reshaping the full development lifecycle—from requirement analysis to design, coding, and testing—significantly improving the R&D performance of core banking systems.

AIStack Drives Business Value Through Scenario-Based Intelligence

In accelerating the practical adoption of AI in financial services, Sunline focuses on two core questions: how to identify high-value business scenarios and how to select the most suitable large language models (LLMs).

To address these, the company has developed a systematic methodology that includes a scenario selection framework and an integrated evaluation toolkit for testing LLM applicability—empowering financial institutions to scientifically assess, match, and deploy AI in high-impact business use cases.

Building on this methodology, Sunline fine-tunes its proprietary LLMs with scenario-specific training and provides a robust toolchain to support intelligent transformation across key financial domains, including smart lending, financial management, regulatory compliance, and big data operations. These solutions enable institutions to rapidly deploy AI in scenarios that deliver measurable gains in cost reduction, efficiency, and risk control—unlocking the full potential of the technology–scenario–value flywheel.

From AI4SE (AI for Software Engineering) to AI4Biz (AI for Business), Sunline’s AIStack solution continuously delivers deployable, customizable, and replicable AI productivity tools—lowering the entry barrier for large-model adoption and deeply integrating AI into real-world financial scenarios. This paves the way for a new era of intelligent finance.

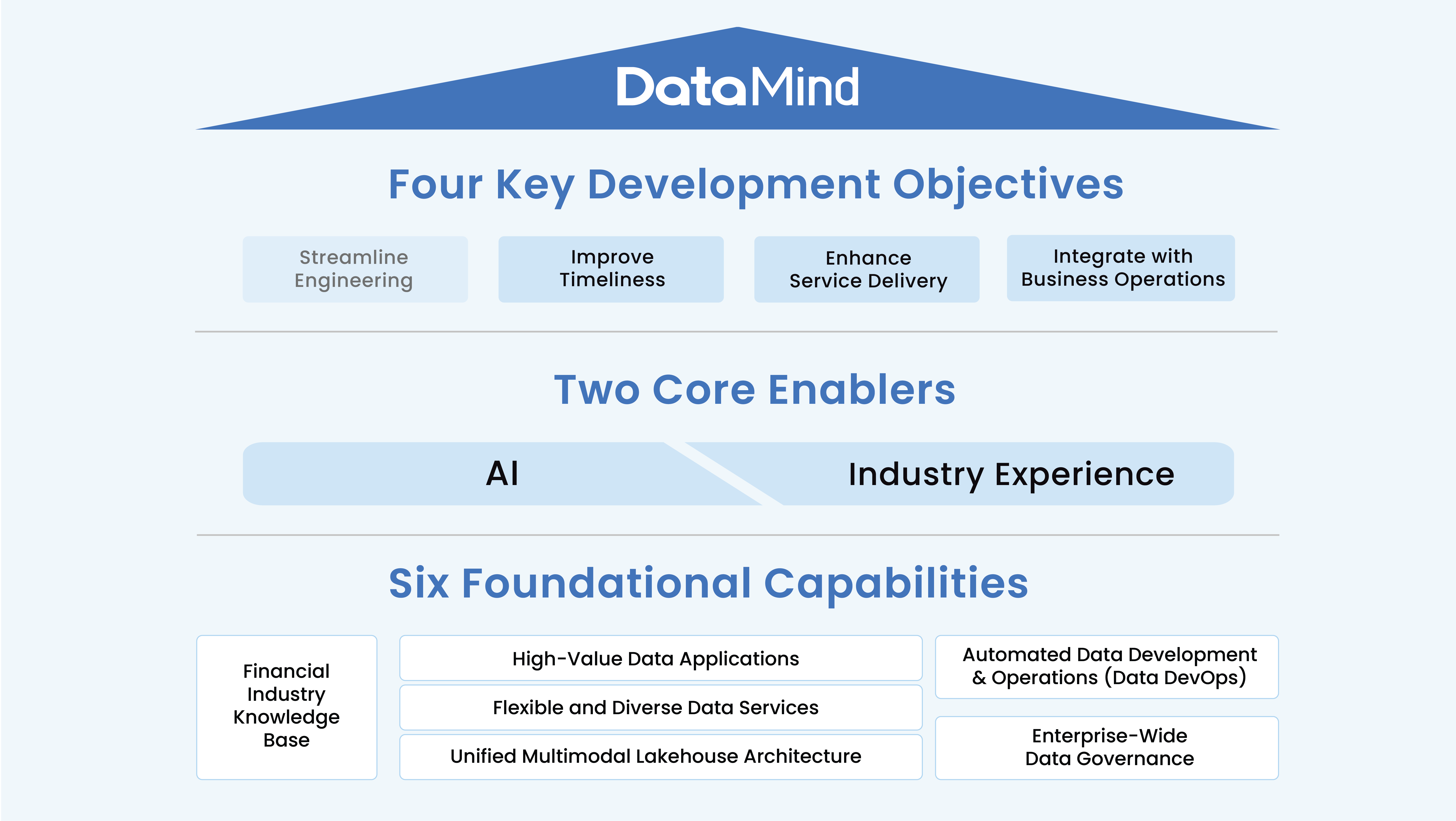

DataMind + AI: Accelerating the Release of Data Value

As the financial industry enters the deep waters of digital transformation, big data applications continue to face numerous practical challenges—difficulties in converting data into business value, such as, low timeliness in real-time processing, limited efficiency in R&D productivity, and constrained service capability.

To address these pressing pain points, Sunline has combined its AI expertise with deep industry experience to develop DataMind—an intelligent, self-developed data engine. At this year’s China International Financial Exhibition, DataMind will show its advanced architecture, core value propositions, and real-world success cases.

Positioned as the "data neural hub" for financial institutions, DataMind seamlessly integrates cutting-edge technologies including AI, Big Data, Cloud, and DataOps, delivering an unified intelligent data platform that supports multi-modal data processing, real-time data lake construction, modular data services, and scenario-driven data applications.

Four Core Pillars Empowering Data-Driven Transformation

Through intelligent data processing and analysis, DataMind significantly reduces the complexity of data engineering, enhances processing efficiency, strengthens data service capabilities, and deeply integrates with business scenarios. It enables financial institutions to build a smart, real-time, and automated data infrastructure, accelerating the deployment of high-value scenarios and unlocking the multiplier effect of data assets—ultimately driving greater business value.

Building an Intelligent Data Pipeline

Leveraging the AIStack foundation, DataMind enables a range of AI-enhanced data use cases such as root cause analysis, automated model design recommendations, self-service SQL development, intelligent data quality checks, natural-language data querying and so on. By tightly integrating algorithms with data engineering pipelines, the platform dramatically improves data processing efficiency and lowers the development threshold—making data a true competitive advantage for financial institutions.

Globally Recognized Product Value

The value of DataMind has earned strong recognition from international clients. A leading bank in Singapore, for example, adopted a “one platform, two-core (1P2C)” architecture integrating Sunline’s transaction engine with DataMind as part of its next-generation digital intelligence system. This integration empowered the core system with enhanced real-time data processing capabilities, providing robust, scalable data support for business growth.

Global Best Practices - Setting the Benchmark for Chinese Fintech’s International Expansion

As Sunline enters the 10th year of its global journey, its international strategy has evolved from simply “going global” to “deep integration” with local markets. At this year’s China International Financial Exhibition, the company showcased several flagship intelligent finance projects and cutting-edge solutions deployed across overseas markets.

Sunline is currently the only Chinese software provider to independently export its self-developed core banking systems to Southeast Asia. The company is leading the modernization of core systems for a top-tier Thai bank, and has established benchmark digital transformation projects in Indonesia, the Philippines, and Malaysia, continuing to expand its regional influence.

Today, Sunline’s international footprint spans Asia, the Middle East, Africa, and Latin America, where it serves more than 60 overseas financial institutions. As digital transformation accelerates in emerging markets like Southeast Asia and the Middle East, Sunline is well-positioned to replicate its proven domestic technology advantages and fully support overseas clients in achieving intelligent, localized, scenario-driven transformation at scale.

Looking Ahead

From technological evolution to real-world value creation, Sunline remains at the forefront of innovation in AI + Finance. Sunline will continue to deepen its efforts in fusing artificial intelligence with financial scenarios—advancing the development of a safer, more efficient, and more intelligent digital financial ecosystem, and driving the high-quality growth of China’s fintech industry to new heights.