Recently, Sunline won the bid for Bank of Pingdingshan’s enterprise-level data center construction project and partnered with Huawei to build an integrated data center for the bank.

In recent years, the concept of ‘centralization’ has been in full swing and transformation of middle-end data systems has emerged in the banking industry. Domestic commercial banks have used data centers to enhance the serviceability of bank data assets and accelerate digital transformation.

In order to realize the mid- and long-term strategic goal of building the most competitive modern bank in China, Bank of Pingdingshan must make full use of the accumulated big data value to empower business development to enhance risk decision-making, customer precision marketing and management analysis in building a fast, efficient and intelligent data middle-end service system to empower Bank of Pingdingshan's digital transformation.

Sunline joins hands with Huawei to provide Bank of Pingdingshan with a data center-station joint solution

In recent years, Sunline's big data business has grown rapidly with big data products landing in many banks. Among the rich financial big data services, Sunline has become more aware of the importance of the integration of big data in core platform. In the pre-consultation and bidding process of Bank of Pingdingshan’s data middle-end project, Sunline and Huawei won the bid in one fell swoop with their highly recognized experiences combined with the bank’s current demand status.

This joint solution is an integrated data center basic system and application system constructed by Sunline’s data center solution, Huawei’s GaussDB distributed data and FusionInsight’s big data platform.

The data center-office joint solution not only improves the stability, high availability and scalability of the bottom layer of Bank of Pingdingshan’s data center-office system but also realizes the unified distribution, management, service and application of data assets across the bank, comprehensively enhancing the bank’s product and service innovation, digital customer awareness and digital risk control level.

Sunline Data Middle-end creates an overall data operation system

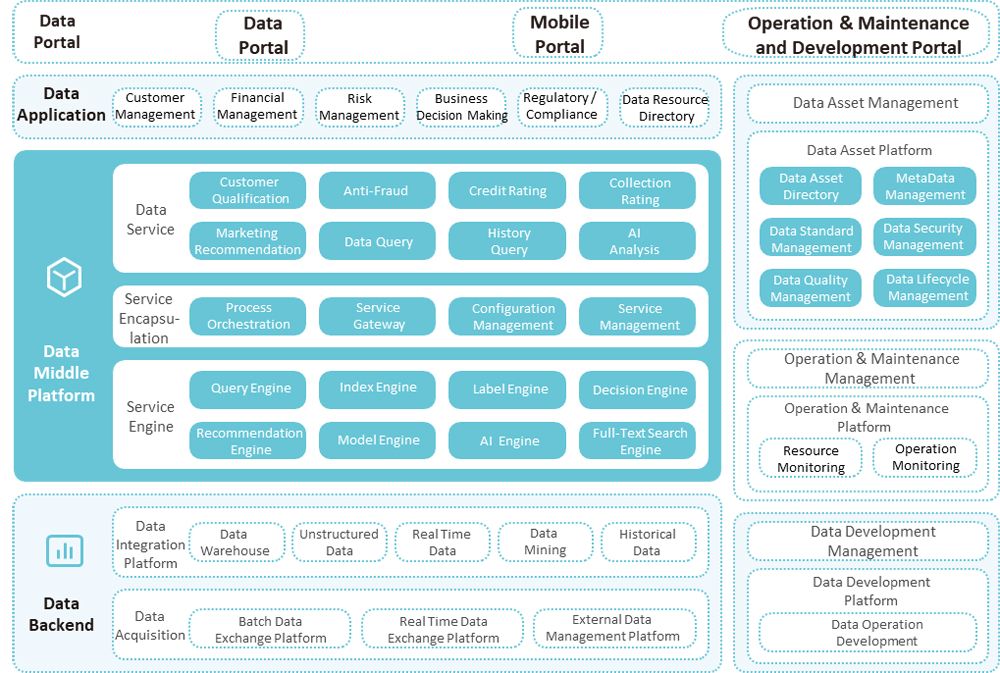

The data center solution of Sunline is an overall data system architecture which integrates the entire data life cycle from data collection, aggregation, calculation to data service and data application, including data back-end, data application, data asset management and data development operation and maintenance as well as the data center in a narrow sense-the data center service layer.

· Data back-end: A basic data platform with industry-leading and mature models, including data warehouse platforms, real-time data platforms, historical data platforms, data exchange platforms, external data management platforms and other products which can provide financial institutions with a solid universal back-end ability.

· Data center service layer: Combine data service platform with the background data service engine and through service encapsulation, forming a closed loop between the data background, data application system and business system, realizing the decoupling of applications and data as well as maintaining close interactions through centralized management and other methods to realize the sharing and use of data between various systems so that bank data can be circulated among various systems and give full play to the value of data assets.

Sunline ‘Large Middle-end, Small Front-end’ Data Center System

Sunline's data middle-end solution can build an overall data operation system for financial institutions based on data assets with a ‘large middle-end, small front-end’ to comprehensively improve the efficiency of financial institutions' data services and drive business development with data:

· Realize enterprise data service reuse

· Avoid redundant construction and reduce the cost of chimney collaboration

· Precipitation of general business capabilities, reducing the burden on the front desk

· Unified service interface, improve operation efficiency

· Enhance corporate management efficiency and product innovation efficiency

With the help of Sunline's data center system, financial institutions not only can form a matrix of various data service capabilities, meeting various applications and users' application requirements for data assets in a platform-based, component-based, self-service and product-based manner but also can lay a solid foundation for the future development of data intelligent applications and the realization of the value of data assets, ultimately improving data service capabilities.

With the advent of the digital age, the value of digital assets has become more important to financial institutions and has gradually become the core driving force for business development. As a leading financial technology company, Sunline has given full play to its deep understanding of its advanced technological capabilities and independent innovation capabilities in the field of big data to help financial institutions make full use of the value of data assets and accelerate their digital transformation.