Solution Overview

Internal Capital Adequacy Assessment Solution

Through the establishment of excellent risk identification, risk assessment, risk management, risk measurement models and a set of relevant governance, policy and business process systems and cooperation with pressure test and other methods and means, Sunline Internal Capital Adequacy Assessment Solution integrates risk management and capital management closely to carry on the dynamic management and planning of the capital. It also ensures that the result of risk measurement and management can connect organically with bank’s daily major business decisions and management process while meeting the second pillar of the compliance standards at the same time. In this way, the bank can plan ahead to improve its core competitiveness under the new competitive environment of interest rate liberalization and economic transformation.

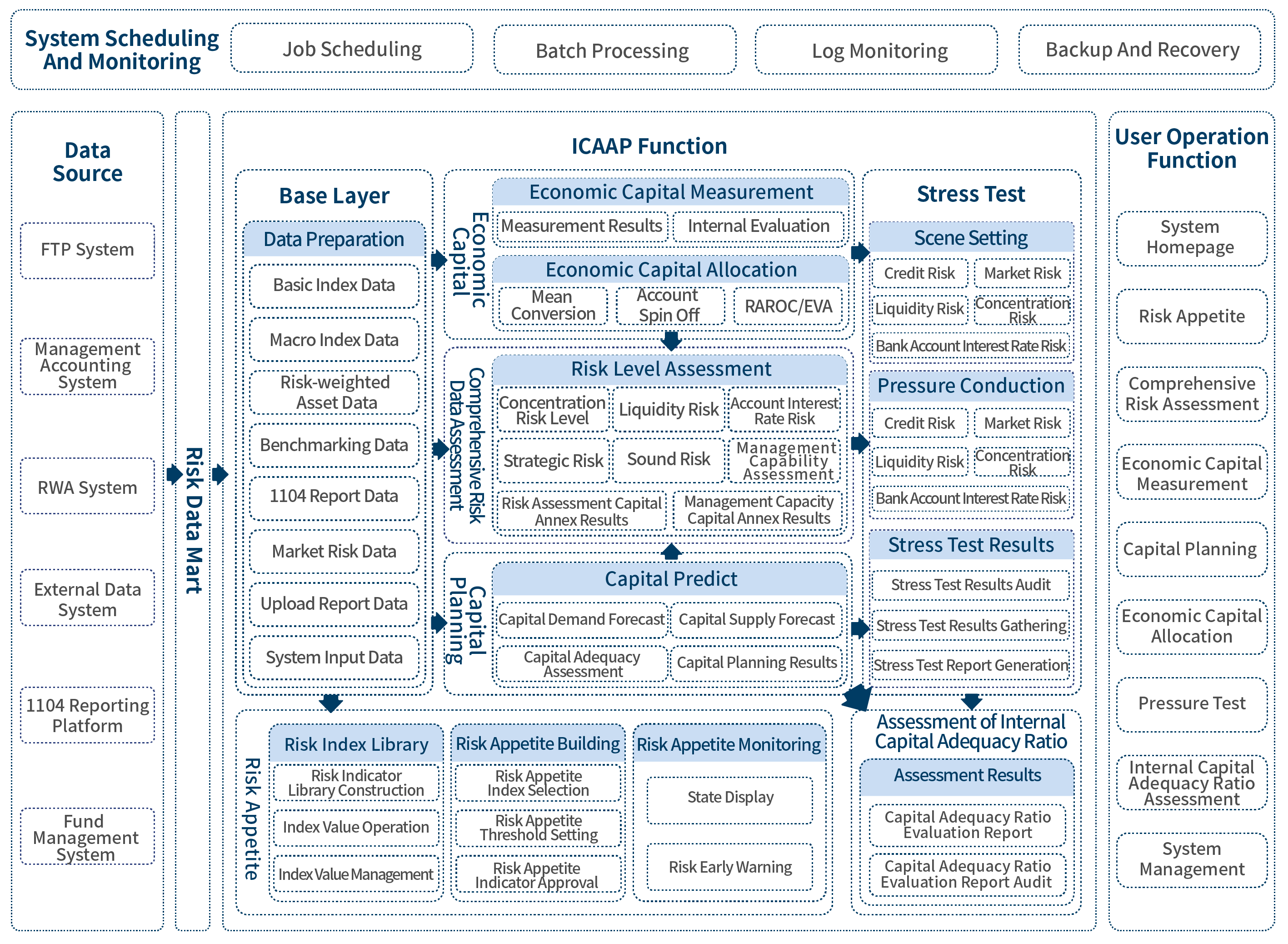

Scheme architecture

Solution Advantages

Solution Values

Typical Customers

Internal capital adequacy assessment system

Related program recommendation