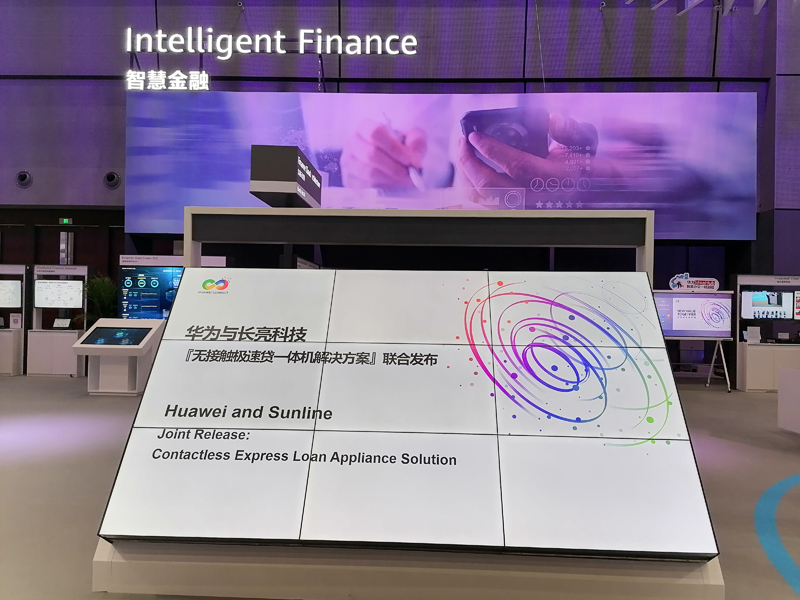

The fifth Huawei Connect Conference was held in Shanghai on September 23 – 26. The theme of the conference was creating ‘New Value Together’, bringing together global industry leaders, business elites and pioneering companies to discuss industry’s latest technologies and the development directions of digitalization. Sunline attended this conference as an important ecological partner of Huawei and officially launched a global contactless financial service solution with Huawei at the conference.

Sunline and Huawei jointly release a fast loan solution, enabling global financial digital services for the post-epidemic era

The innovative technologies represented by artificial intelligence, big data, 5G, etc. are accelerating the construction of a smart world with all things connected and the sudden epidemic earlier in the year has drove deeper awareness on the importance of industry digitization and intelligence. With the push, all walks of life will be accelerating the expansion of digital application boundaries.

In order to meet the urgent needs for financial digital services during the post-epidemic response period, Sunline and Huawei formally launched a global contactless financial service - fast loan solution at the Huawei Connect 2020. The program will be applied to many countries and regions in Southeast Asia, the Middle East, South America and Africa.

Li Hongguang, Senior Vice President of Sunline said during the meeting, “In the post-epidemic era, all countries are actively responding. As financial institutions are the cornerstones of a country’s economy, non-contact digital and online financial services capabilities are particularly important. The stable and orderly operation of the financial market can also meet the daily financial business demands of customers. As a global financial technology company, Sunline also has deep understanding on technological innovation, digital services and open finance to help global financial institutions manage urgent demand for contactless services during and after the epidemic.

In order to allow financial institutions and locals in areas with weak technological power to enjoy the convenience brought by technology, Sunline and Huawei jointly launched a cost-effective and fast loan solution which can meet the needs of financial institutions of any sizes. We hope this solution will be a way to provide practical care and help for the people in this era."

Li Hongguang, Senior Vice President of Sunline (first from left)

The fast loan solution runs on EDSP, the latest bank enterprise microservice framework platform launched by Sunline this year and is built on Huawei FusionCube. It has the characteristics of a full online, open, second-level lending and TTM 1-day which can help financial institutions in fully realize contactless digital banking services like loan product marketing, remote customer registration, personal portrait, risk assessment, fund issuance, post-loan processing and other financial services, meeting the increasingly personalized development needs of financial institutions.

One of the biggest features of the fast loan solution are ‘speed and convenience’, which are mainly manifested in:

□ Convenient remote account opening with identity verification through multiple smart authentication methods such as biometrics.

□ Fast online loan and post-loan processing enabling 3-minute application, 1-second loan, 0 manual intervention, instant post-loan extension and review feedback.

□ Fast product marketing to provide real-time formation of promotional products and real-time product marketing promotion.

□ Fast access to ecosystem partners via standard Open API interface and quickly connects to the ecosystem.

□ Rapid deployment that enable the system to be put into production and use within 2 months.

With the advent of the banking 4.0 open ecosystem, the fast loan solution will help global financial institutions fully transform towards digitalization and openness.

Two additional joint solutions unveiled at the HC conference

In addition to the fast loan solution, Sunline and Huawei's joint Distributed Core System Solution and Financial Convergence Data Lake Solution running on Kunpeng’s Ecosystem were also unveiled at this HC conference.

1. Kunpeng Distributed Core System Solution

An overall solution built on Sunline 's distributed core business system and Kunpeng server. The solution adopts the design concept of a distributed technology architecture and microservices, and integrates product design, operation mode and scene integration. Data provision, open interconnection and other aspects provide efficient support for banks, helping banks to fully realize the security and control of core business systems.

2. Financial Convergence Data Lake Solution

Composed of ‘acquisition-consolidation-management-calculation-application" solution provided for financial industry data. Running on Sunline’s software and Huawei's hardware infrastructure, the solution completely integrates to the data application architecture, solving ineffective data assets management in during data acquisition, storage and calculation, allowing the system to meet the needs of different scenarios and time-sensitive data services, fully realizing the value of data assets.

As a global financial technology leader, Sunline started its overseas expansion as early as 2016 with offices in Singapore, Malaysia, Thailand, Indonesia, Hong Kong and more. Sunline is continuously innovating and is highly recognized by foreign markets and customers for its market leadership and product performance. In the future, Sunline will continue to adhere to its global vision, joining forces with Huawei to help global financial institutions achieve intelligent and digital upgrades through excellence in their respective fields.