Solution Overview

Comprehensive Tax Management Solution

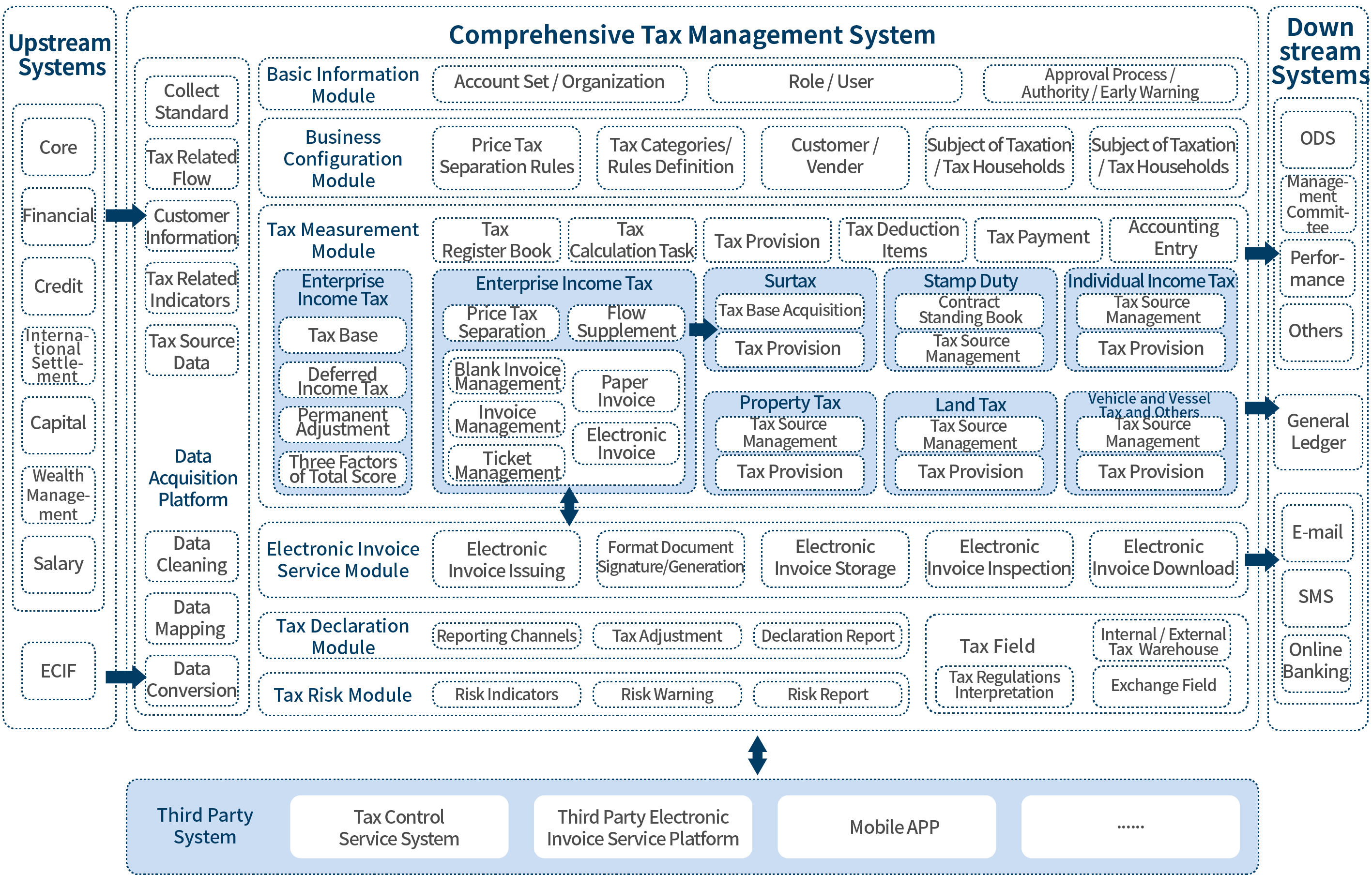

Sunline Comprehensive Tax Management Solution manages the tax-related affairs for all types of taxes including the financial institutions' value-added tax and its additional taxes, stamp duty, property tax, land use tax, vehicle and ship tax, individual income tax, enterprise income tax, etc. In addition, Sunline Comprehensive Tax Management Solution also collects the corresponding business data of each tax to form the tax-related files, calculate and draw the corresponding taxes and automatically issue the tax declaration statements; It centralizes the functions of VAT price and tax separation, sales management, input management, invoicing, income tax final settlement, etc. It can analyze the tax burden of each tax in time for tax planning.

Scheme architecture

Solution Advantages

Solution Values

Typical Customers

Business data collection

Vat management

Tax index management

Calculation and withdrawal of all kinds of taxes

Final settlement

Tax analysis

Tax risk early warning