Solution Overview

End-to-end Credit Card Business Solution

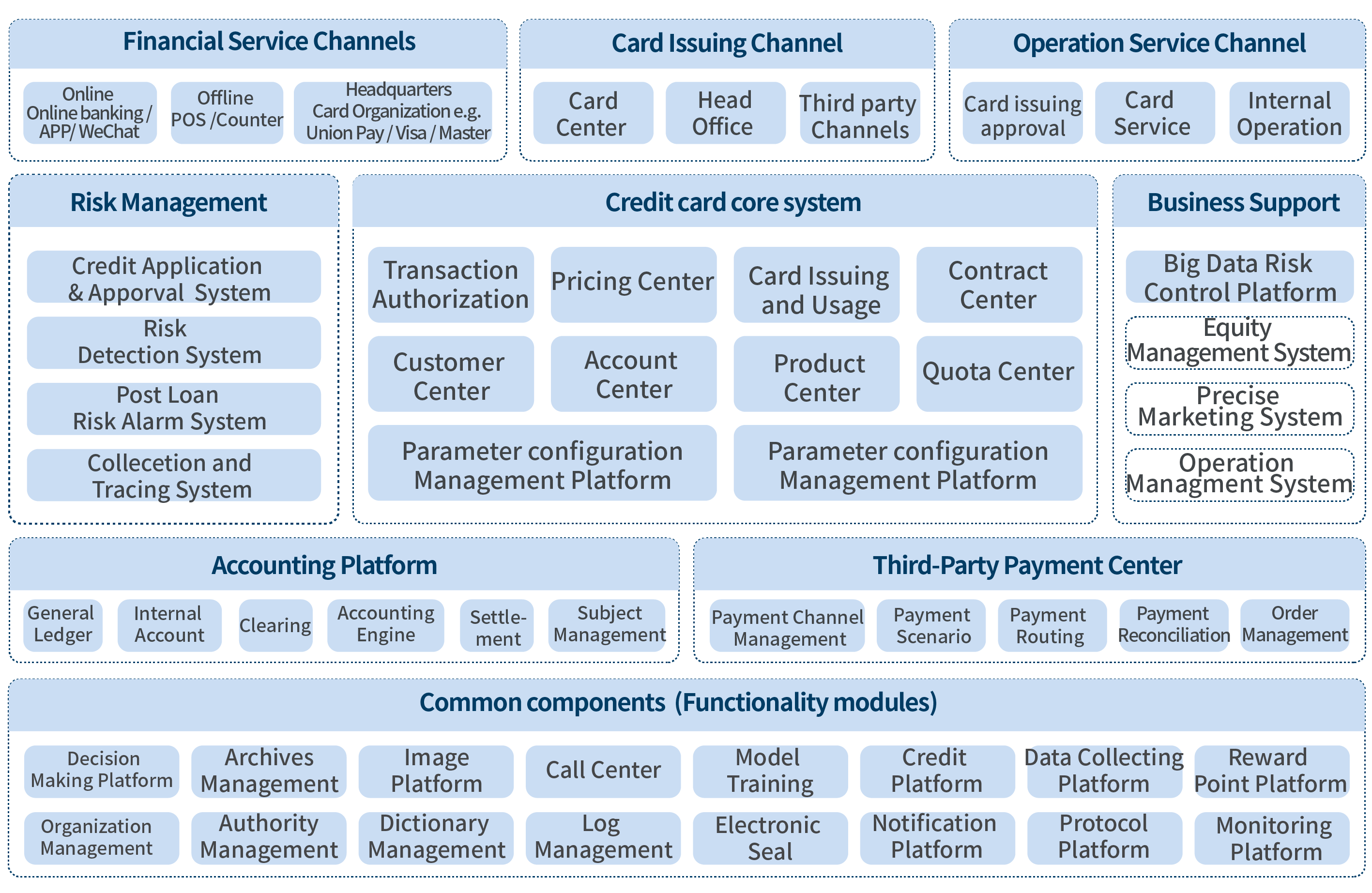

Sunline End-to-end Credit Card Business Platform runs through the full life period of commercial banks' credit cards, providing overall IT solutions including risk control, accounting, management and marketing. Among them, the core business system is based on the concept of microservices and unified distributed architecture which adopts the loose coupling mode of each competency center in their construction. The pre-loan approval system takes a rich risk control strategy model as the foundation of pre-loan risk prevention and control, which integrates card issuance approval, amount adjustment approval, large-sum installment approval, anti-fraud application, risk control and detection rules. The post-loan management system can identify, analyze and measure the asset credit risk status of credit granting customers in a timely manner as well as realize the automation of collection business and tracking of the entire process. The big data risk control and intelligent marketing platform covers the whole link management from precision marketing at the user end to risk management at the operation end through the integration of online scene, automatic process and intelligent risk control decision.

Scheme architecture

Solution Advantages

Solution Values

Typical Customers

Credit card core business system

Credit card application approval system

Credit card risks detective system

Credit card post-loan warning system

Credit card debt-collection tracking system

Credit card big data risks control platform

Credit card precision marketing system

Related program recommendation