Solution Overview

Loan Accounting Solution

Sunline Loan Accounting Solution supports the accounting business of loans in different scenarios and different formats to meet the accounting requirements of loans on Internet platforms and traditional personal loans; It also has a flexible, mature and extensible technical framework and a strong and complete trading and accounting function, which can provide good support for the future business development of cooperative loans on the bank's Internet platform and traditional proprietary loans.

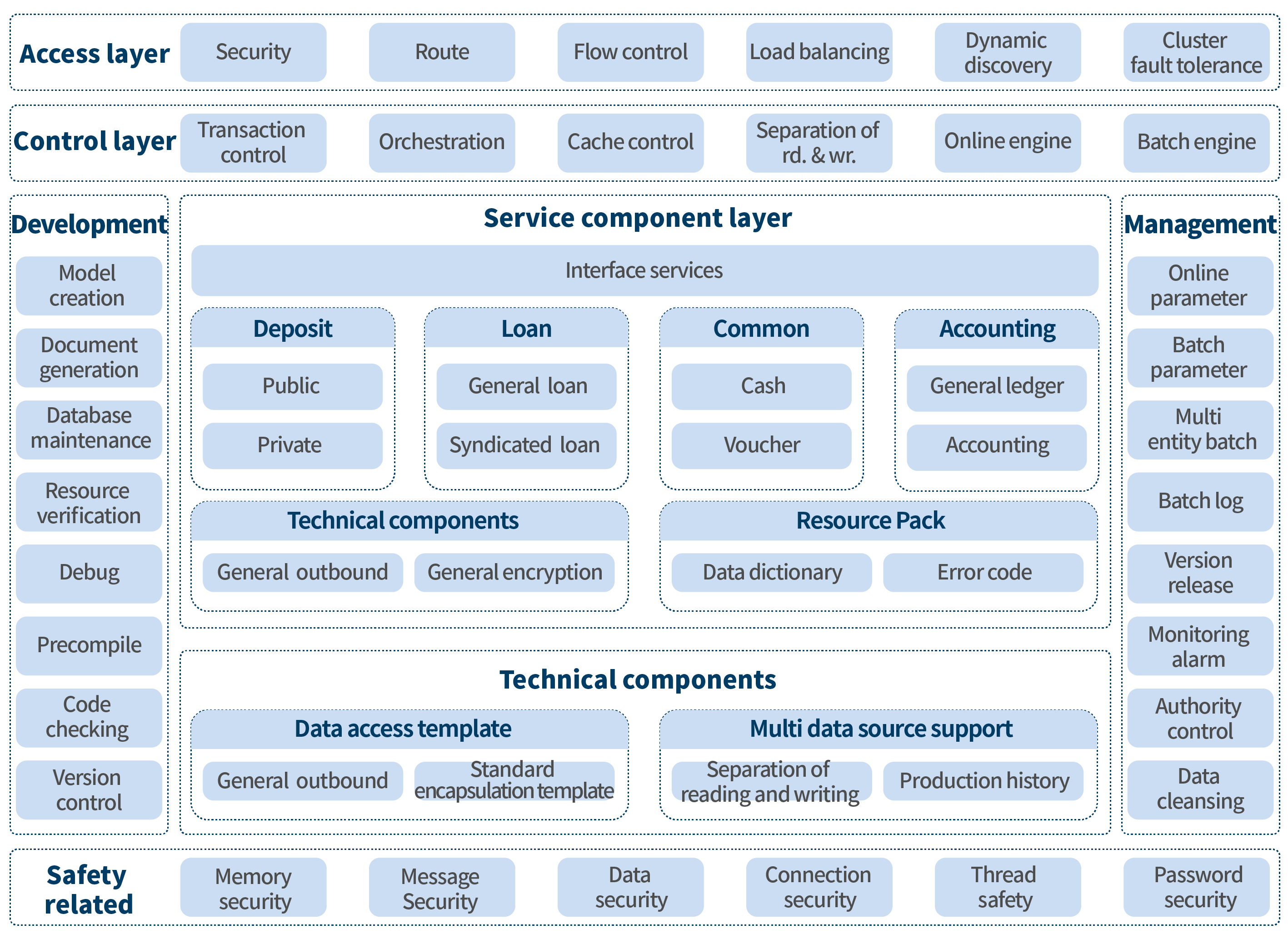

Scheme architecture

Solution Advantages

Solution Values

Typical Customers

Loan accounting system

Related program recommendation