Solution Overview

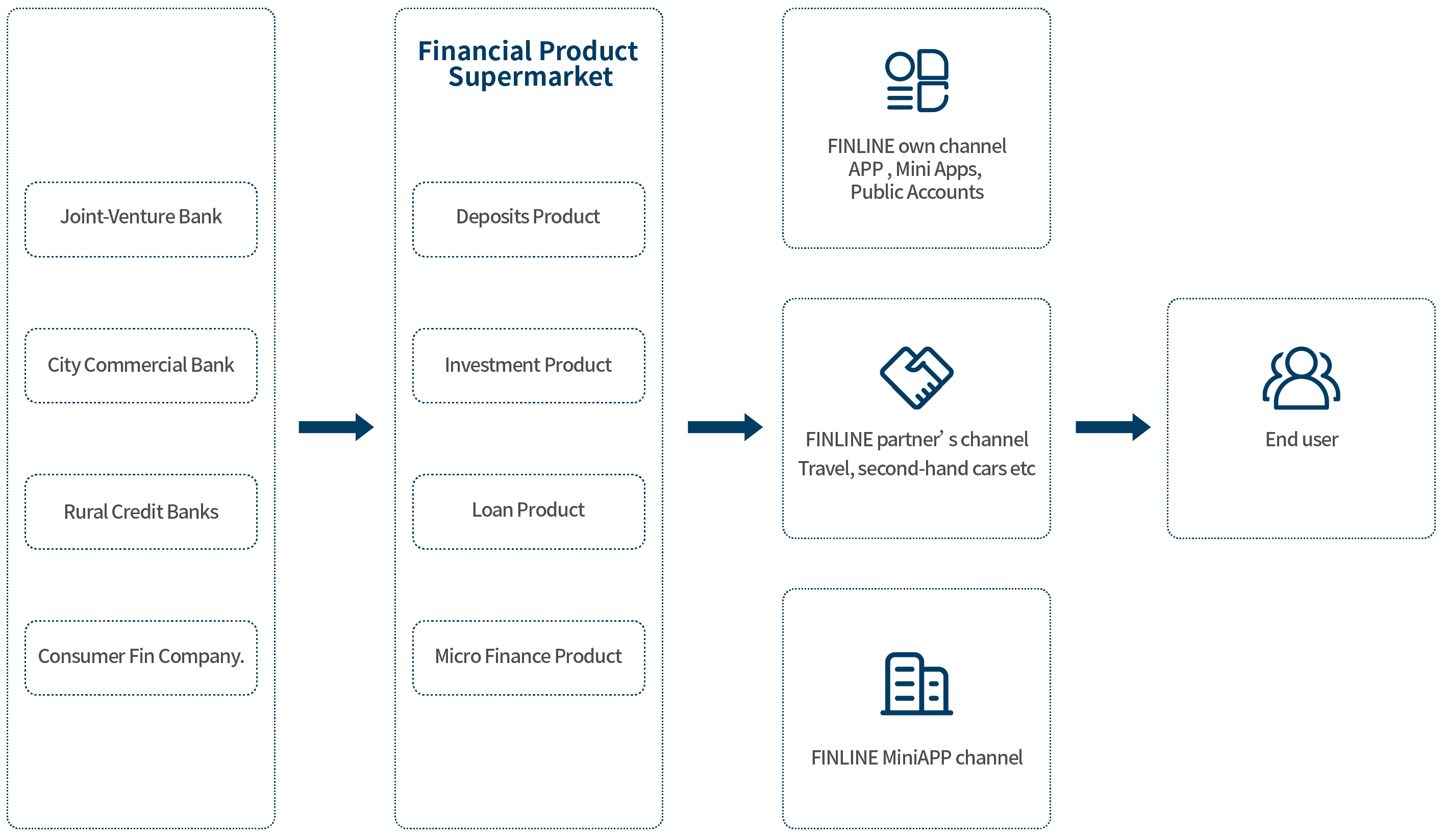

Financial Product Supermarket Business Solution

Relying on the long-term accumulation in the FinTech field, Sunline integrates the financial products and services of the bank and conducts on-line transformation. Seamlessly integrate the traffic platform and banking portal through FinConnect platform and provide customers with all-round financial services, financial product services and featured services in-depth scenarios. Among them, financial services include account management, inquiry, account opening and transfer, etc. Financial product services include deposit, loan and financial management characteristic service include points, events, advertising, product recommendations and so on.

Scheme architecture

Solution Advantages

Solution Values

Related program recommendation