Solution Overview

Digital Banking Solution

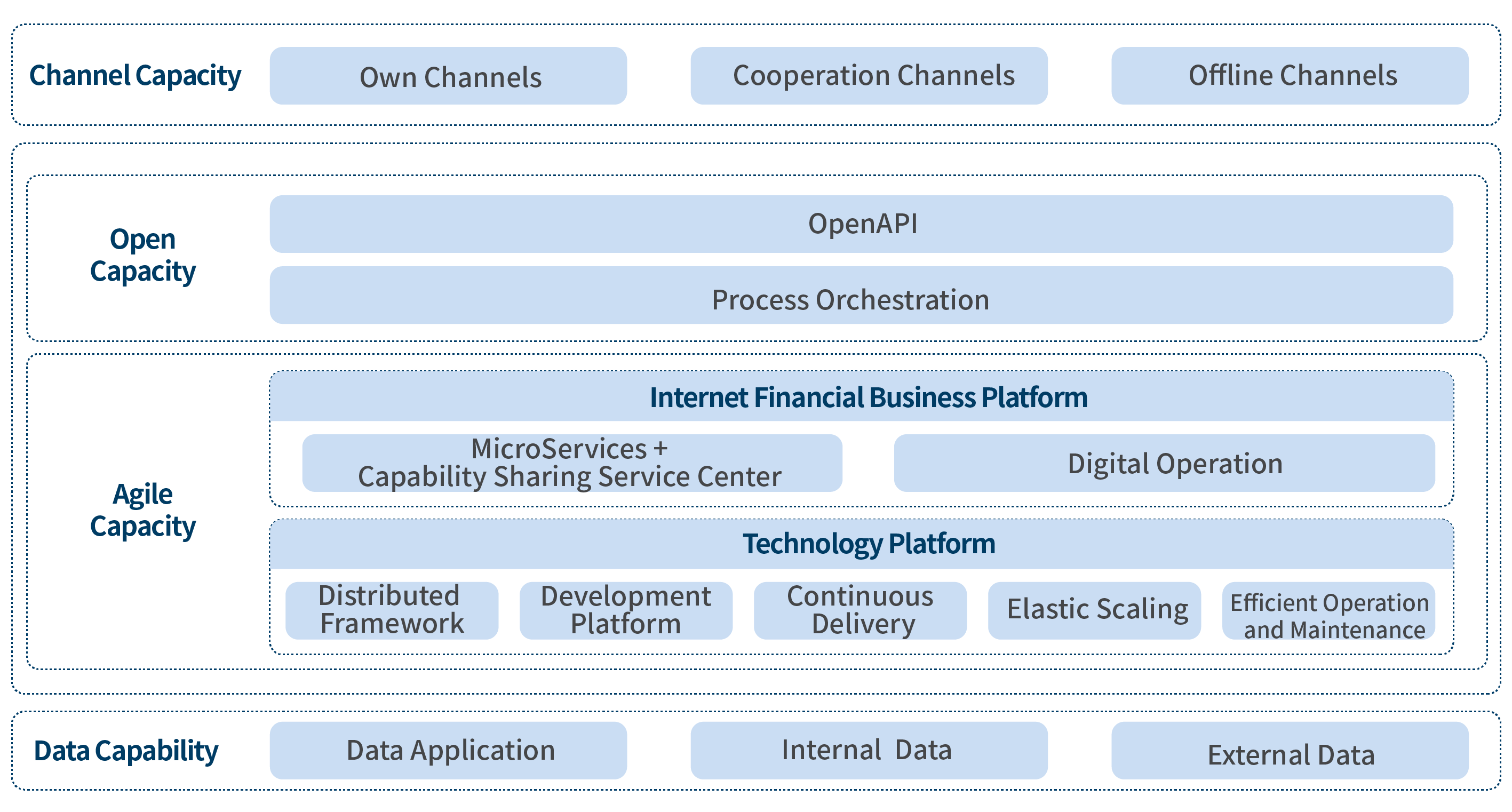

Based on the unified technology stack, Sunline Digital Banking Solution solves the complex interaction and other problems among heterogeneous systems through the construction of single microservices applications. This is a comprehensive solution to realize iterative development of sensitive business state in the future and design sufficient decoupling. Its competency center uses loose coupling model and integrates user, account, interest rate, fee, quota, product, marketing, partner (cooperation partner), platform account, payment, clearing and accounting as a whole. It uses open interface model which provides service invocation for open platform and boasts the ability to provide support all types of Internet business scenes. Sunline Digital Banking Solution is an integration solution to realize acquiring gust form the front desk and managing in the middle and receiving support from the background. Typical applications include the construction of Internet core, business center, Internet credit, open platform, payment platform and other systems, supporting continuous expansion and update of single applications in the unified technology system and meeting the flexible development of diversified, personalized and multi-tiered business services.

Scheme architecture

Solution Advantages

Solution Values

Product Composition

Digital core banking system

Digital credit platform

Digital open platform

Product sales factory

Digital unified payment platform

Digital financial business platform

Related program recommendation