July 26 marks the go-live of Beijing Rural Commercial Bank’s new generation core system implemented by Sunline. Its technical capabilities and performance doubled and have become the new benchmark for China’s rural commercial banks core.

Beijing Rural Commercial Bank starts to shares their insights on their prosperity in technology

Beijing Rural Commercial Bank is the first provincial joint-stock rural commercial bank approved by the State Council. The bank’s basic financial services cover all the towns and villages in Beijing and its asset scale has exceeded RMB 1 trillion. In order to realize the bank’s IT strategy to comprehensively improve the bank's service level and industry competitiveness, Beijing Rural Commercial Bank has proactively initiated the construction of a new generation core banking system to support its development and future proof its business.

The change of core is a huge project in the history of Beijing Rural Commercial Bank's IT construction with the involvement of more than 110 systems. It is necessary to build the basic IT architecture and develop business function modules as well as complete high-quality data migration in a complex and huge legacy system to ensure business continuity. In summary, the scale, scope and difficulty of project construction were unprecedented.

After in-depth evaluation of many core system vendors from multiple dimensions such as product functions, technical architecture, system performance, and service capabilities, Beijing Rural Commercial Bank have made the decision to assign this arduous task to Sunline.

The high standards to build a benchmark for the core system of a rural commercial bank

The implementation of Beijing Rural Commercial Bank's new core system project has officially begun in March 2020.

The core system refresh project is an important part of Beijing Rural Commercial Bank’s five-year development strategic plan. To enable the new core to truly empower business development and become a strong support for the new development pattern of the bank’s financial services, the key technology base must be advanced with higher performance than the industry standard.

"Our project team were faced with great pressure during that time. A lot of energy were involved to come out with an advanced technical architecture for this project. Moreover, with the high standard for the performance of the new core system in terms of day-to-day performance including a 30-minute final batch processing time and a 1-hour quarter-end final batch processing time, making this even more difficult.” Recalling the project situation at that time, Lu Gong, the project manager of Sunline.

The current day-to-day final batch processing time for the bank’s legacy core takes 1 hour and the quarter-end final batch processing time takes 2 hours, which means the new core will have to achieve double the performance compared to the legacy system. Hence, the difficulty is also doubled.

In order to help Beijing Rural Commercial Bank achieve the improvement with the new generation core system technology, Sunline sent R&D experts from the headquarters to communicate with the bank on the advanced needs of core technology. The project team members fully analyzed and sorted out the needs and characteristics of Beijing Rural Commercial Bank's system. By putting forward a number of implementation plans, continuous communication, repeated optimization, Sunline’s project team finally established the best practice for the bank.

Despite the huge pressure, Lu was confident to deliver the projects smoothly. "Our technical architecture has always been leading the industry so we have full confidence. In terms of performance, apart from our experience of almost two decades, the quality of our solutions has also been verified by many customers. Based on the system construction experience, everyone finally found the most suitable solution. According to the characteristics of the bank’s data, the data was split and processed in advance before being optimized. Sure enough, after a period of tuning based on this program, the batch processing time was greatly reduced."

After about 500 days of implementation, the new core system for Beijing Rural Commercial Bank has gone through the status reviews, requirements preparations, design and development, comprehensive testing, production drills and has finally reached online testing.

The successful launching of Beijing Rural Commercial Bank’s new core

On July 26, the new core system of Beijing Rural Commercial Bank was successfully put into production. After the launch, the concurrent processing capacity of the new core has increased to 12,000 transactions per second. The batch processing time on weekdays was shortened to less than 20 minutes and the interest was able to be settled at the end of the quarter. The day-end batch processing time has shortened to less than 30 minutes, taking only 12 minutes to complete the deduction of 1 million transactions, doubling the efficiency and completely solving the system bottleneck problem of Beijing Rural Commercial Bank’s social security agency and other large-scale agency services.

Group photo during the launching of Beijing Rural Commercial Bank’s new core

Sunline has built a new generation core system for Beijing Rural Commercial Bank with functional services, product modeling, interest rate marketization, business processing, refined management and architectural componentization in the areas of customer service, product management, business process and risk. Key links such as management and control have been empowered and upgraded to provide a strong engine for the new journey of the bank.

Excellent business performance achieved via the advanced capabilities of the core system:

1. Advanced technical architecture efficiently support the development of banking business and beyond

The new generation core system adopts an open technical architecture system which has good cross-platform and cross-database performance, meeting the deployment of localized X86 mainframes as well as greatly reduces hardware and subsequent maintenance costs.

At the same time, adopting Sunline's own gateway service to solve the lightweight unified access and output of internal and peripheral applications provides interactive traffic management features (security, routing, authentication, current limiting, etc.), especially the gray-scale release mode of the program version which completely solves the security risk of the new version being fully online. Through the small-flow verification method, the problems in the product can be found, adjusted and optimized in the gray-scale stage and be iterated smoothly.

2. Business processing capabilities and efficiency have been greatly improved

The new generation core system realizes core capabilities such as flexible product configuration, rapid customization, differentiated customer pricing, unified channel support, multi-legal person support and refined data collection. It can provide banks with comprehensive channels and flexible operation support to help rapid product innovation, scientific risk management and comprehensive business processing capabilities improvement and efficiency, ultimately providing customers with better services.

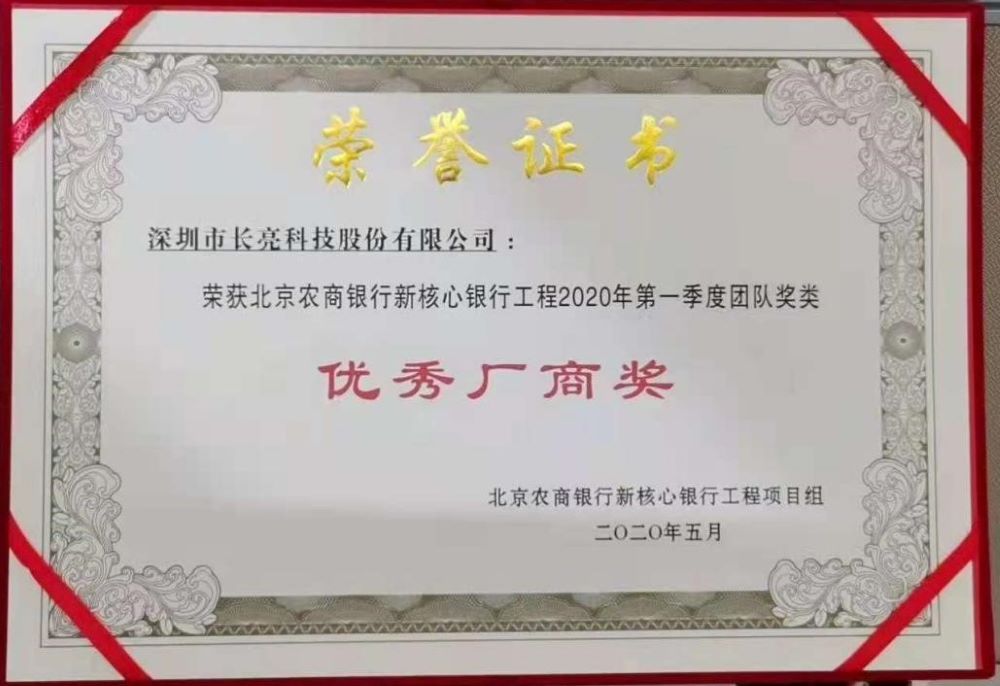

During the implementation of the project, Sunline's project team's professional services, quick response to needs and ability to actively coordinate and promote the project have been praised by senior leaders of the bank for many times and Sunline have been rated as an excellent manufacturer by the industry for their outstanding performance.

The successful commissioning of the new generation core system has laid a solid foundation for Beijing Rural Commercial Bank's future high-quality and sustainable development by strengthening the data empowerment, reshaping the financial service model and advancing the digital transformation of the bank’s business. In the past 20 years, Sunline has continued to lead the development of core systems with one benchmark project after another, accelerating the digital transformation of banks around the world.