Recently, under the guidance of the Central Bank, the Beijing Fintech Alliance released the “Financial Application Alliance Chain Technology Privacy Protection Research Report", and Sunline, as a member of the Alliance and a leading financial technology service provider, was knee deep in the preparation of the report.

In recent years, privacy computing technology has received attention from the industry, and although the application of privacy computing technology in the financial field can ensure data security, there are deficiencies in data confirmation and pricing, trusted depository evidence, and malicious node detection. On the other hand, blockchain establishes a trust foundation between participants through the consensus mechanism, and realizes the authenticity verification and auditing of on-chain data through smart contracts, which has the advantages of being difficult to tamper with and is more traceable.

Will the combination of the two effectively improve the security of data circulation and provide a new technical path for data sharing?

The Data Committee of the Beijing Fintech Alliance organized relevant member units to carry out financial application research on the combination of privacy computing technology and alliance chain, and compiled the “Financial Application Alliance Chain Technology Privacy Protection Research Report". Sunline, together with more than 20 units such as Industrial and Commercial Bank of China, Bank of Communications, Bank of China, Huawei, Tencent Cloud, etc., jointly participated in the compilation, focusing on the practice cases of alliance chain and privacy computing combined with joint risk control modeling, anti-money laundering, intelligent site selection and whitelist sharing, exploring the application value of cutting-edge technologies in the financial industry.

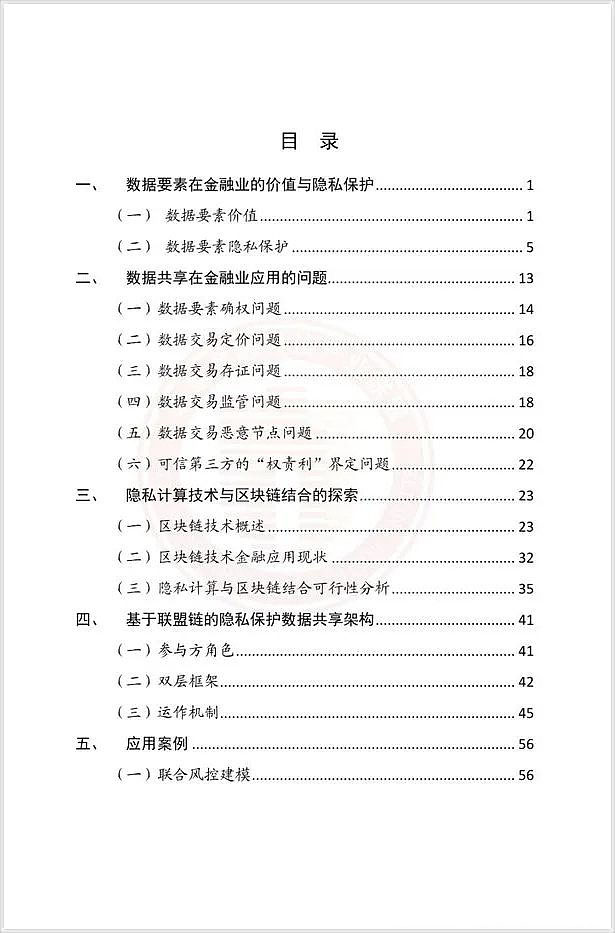

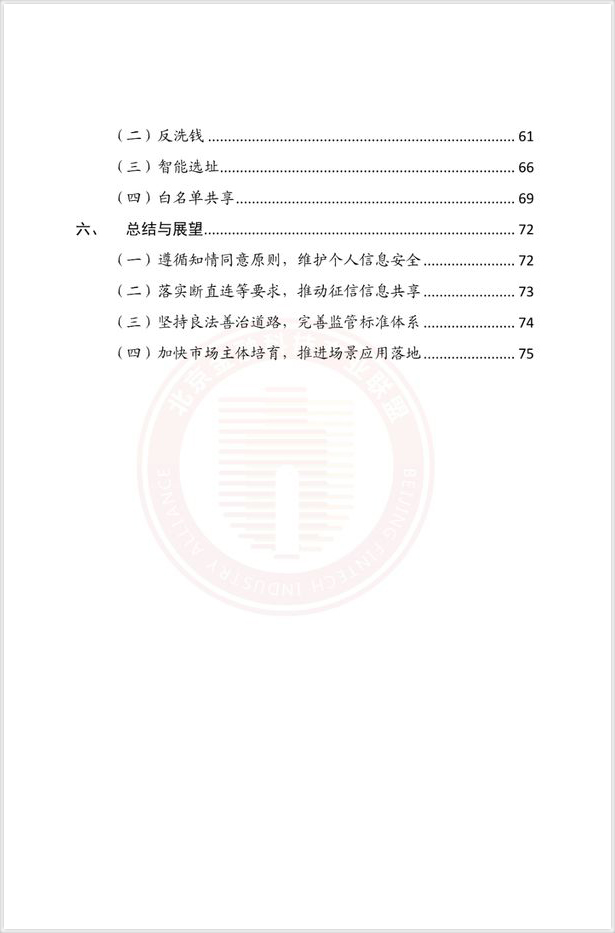

The report comprehensively introduces the value and privacy protection of data elements in the financial industry, the application of data sharing in the financial industry, the exploration of the combination of privacy computing technology and blockchain, the privacy protection data sharing architecture based on the consortium chain, the application cases and the summary prospects, etc., providing a reference for the application of the consortium chain technology in the privacy protection field of the financial industry.

In the exploration and practice of alliance chain and privacy computing technology, Sunline adheres to the concept of professionalism and innovation as the foundation of its establishment, and carries out multiple business areas such as middle-office, inter-agency reconciliation, risk prevention and control, and regulatory compliance in the provident fund industry based on Hyperledger Fabric, FISCO-BCOS, enterprise Ethereum Quorum and other well-known blockchain platforms in China and abroad to develop a universal chain adaptation engine, creating an anti-money laundering application based on alliance chain technology and other technical solutions, leading the innovative development of anti-money laundering business of regulatory authorities and financial institutions, and solving the problems of difficulty in trust transmission, difficulty in trust collaboration and high cost of regulatory audit by:

1. Introduction of the alliance chain technology through the adaptation and docking of open source blockchain platforms such as Hyperledger Fabric, FISCO-BCOS, enterprise Ethereum Quorum, etc., to realize the digitization, automation and intelligence of anti-money laundering regulatory rules.

2. Using smart contracts to complete real-time supervision and data sharing, and promote the further improvement of anti-money laundering prevention, in-process monitoring and post-event disposal of financial institutions

Sunline has nearly 20 years of practical experience in consulting services, product research and development in the field of big data, and participated in the compilation of the “Financial Application Alliance Chain Technology Privacy Protection Research Report", which represents the company's technical strength in big data and has been recognized by the industry. In the future, Sunline will give full play to its own advantages, accelerate the technological innovation of data elements, actively explore the best path to achieve the balance between data application and data security, and fully support the digital transformation of financial institutions!